ALICO (ALCO)·Q1 2026 Earnings Summary

Alico Turns EBITDA Positive as Land Strategy Takes Hold

February 5, 2026 · by Fintool AI Agent

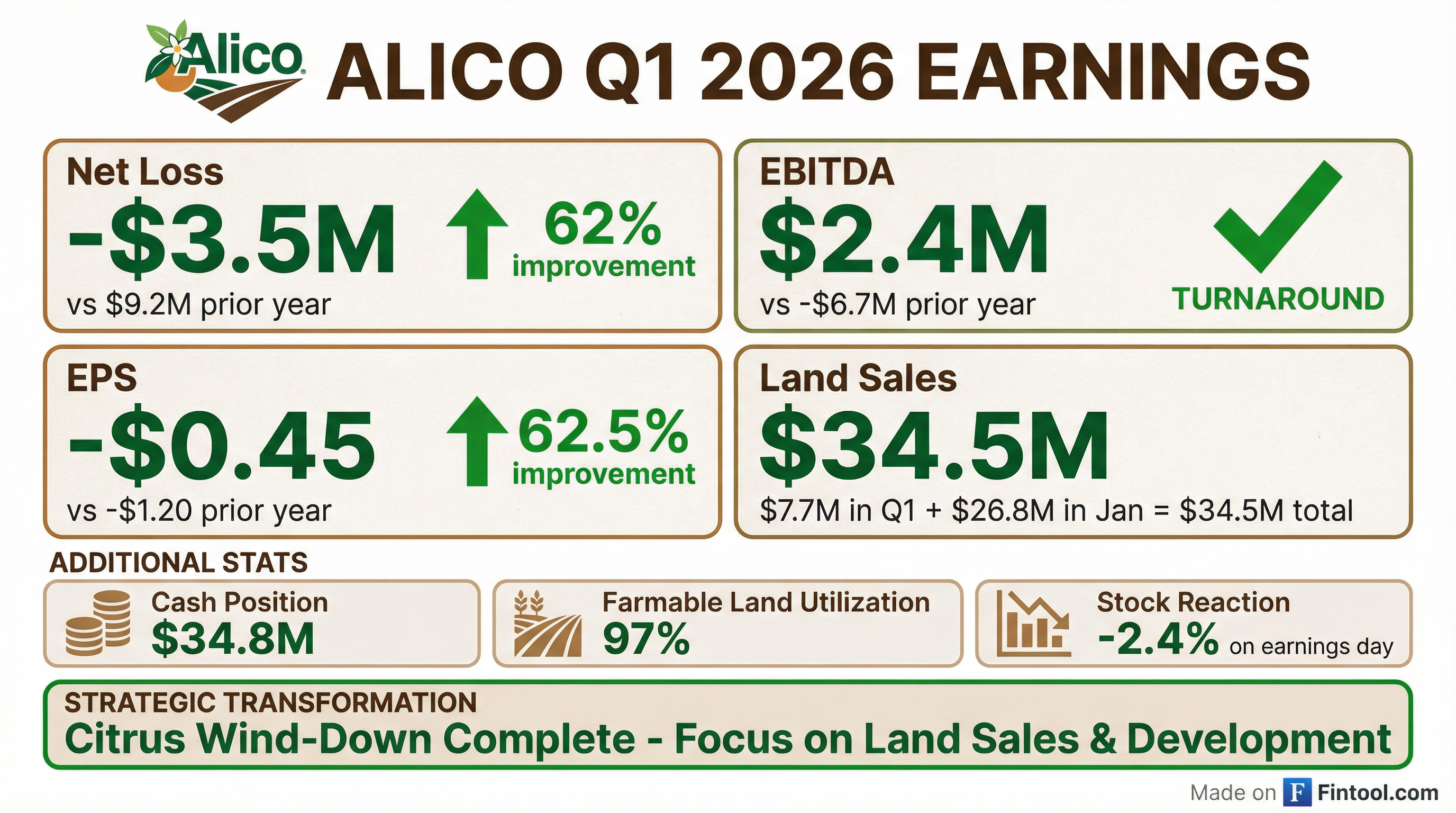

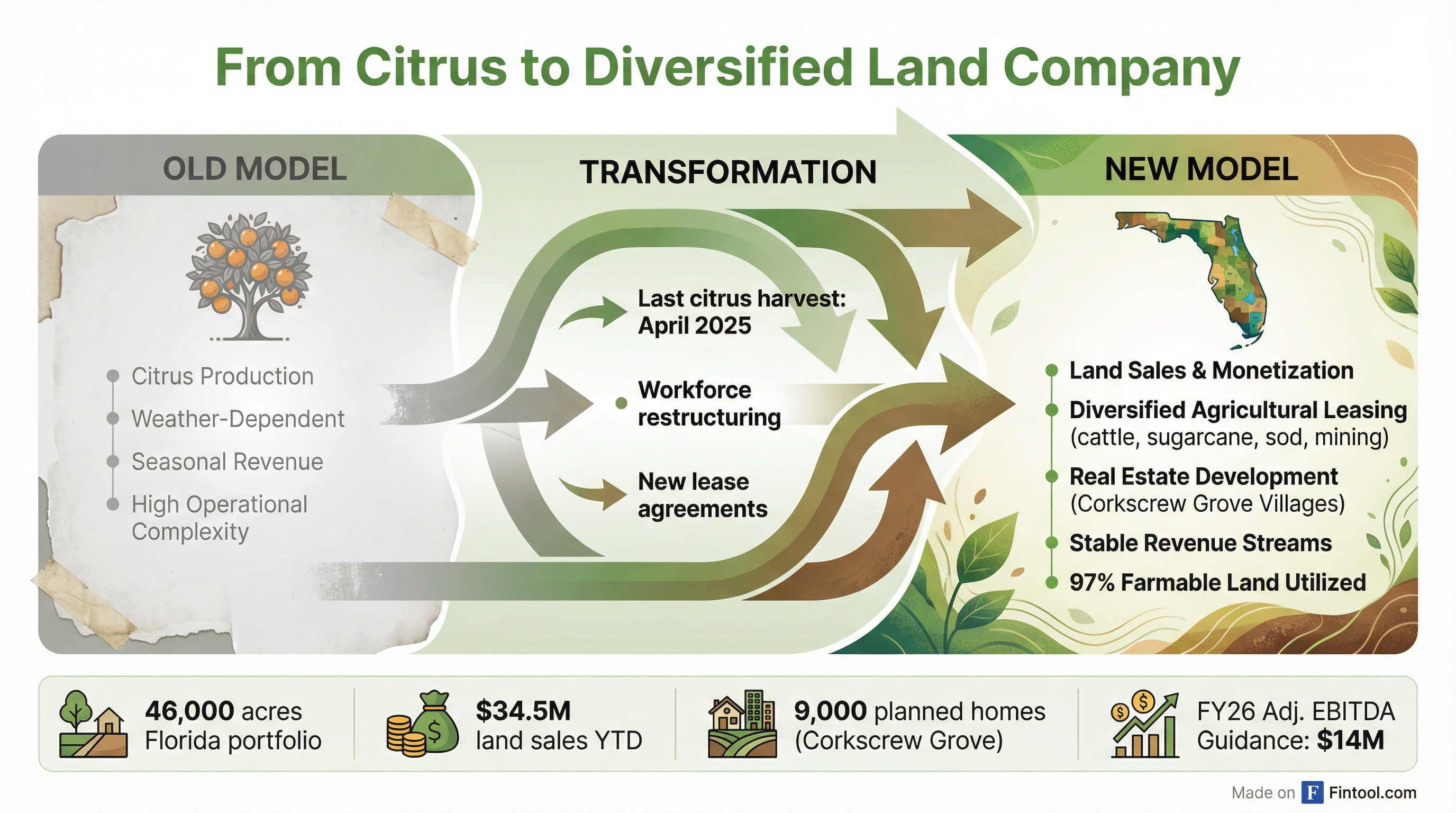

Alico, Inc. (NASDAQ: ALCO) delivered Q1 2026 results that validated its strategic transformation from citrus producer to diversified land company. EBITDA swung to positive $2.4M from negative $6.7M a year ago, while net loss narrowed 62% to $3.5M.

The Florida-based agribusiness closed $7.7M in land sales during the quarter, with total land sales reaching $34.5M year-to-date through January 2026. Farmable land utilization hit 97% following new lease agreements, creating the stable revenue foundation management promised.

Did Alico Beat Earnings?

Alico has minimal analyst coverage, making formal beat/miss comparisons unreliable. What matters is the directional improvement:

The 89% revenue decline reflects the planned wind-down of citrus operations—the company completed its last significant citrus harvest in April 2025. This wasn't a business deterioration but a strategic exit from weather-dependent farming toward asset monetization.

The $4.9M gain on land sales this quarter (vs. $0 a year ago) drove most of the bottom-line improvement.

What Changed From Last Quarter?

The citrus exit is complete. Revenue from Alico Citrus dropped to $0.9M from $16.3M in the prior year, with cost of sales falling proportionally. The prior year included significant inventory write-down from Hurricane Milton damage—that volatility is now behind them.

Land leasing hit critical mass. Following new agreements signed in January 2026, Alico achieved 97% utilization of its ~32,500 farmable acres. Revenue-sharing agreements now span citrus growers, cattle operators, mining operators, sugarcane producers, and sod farming operations.

Bayer partnership expands agricultural footprint. Alico entered a 10-year lease with Bayer Crop Science to establish an agricultural research station on 100 acres in Charlotte County.

Florida DOT wildlife underpass. Alico announced a $5M strategic partnership with Florida DOT to design and construct a wildlife underpass as part of the State Road 82 expansion—demonstrating the conservation credibility that management says "sets Alico apart in the development community."

What Did Management Guide?

Alico provided specific FY2026 guidance that demonstrates confidence in the new model:

Management noted that these figures could change if capital is returned to shareholders via dividends, share repurchases, or tender offers.

What Did Management Say?

CEO John Kiernan emphasized the transformation narrative:

"We believe these results and transactions demonstrate that Alico has a business model that will continue to unlock substantial value from its land portfolio while maintaining our commitment to responsible land stewardship."

On the valuation disconnect:

"Management's comprehensive NPV analysis of our approximately 46,000 acres indicates a market value of assets between $650 million and $750 million. With our current market capitalization of approximately $320 million, and net debt of approximately $50.7 million at quarter end, we believe Alico represents compelling value for investors seeking exposure to Florida's continued growth story."

On capital deployment optionality:

"With our strengthened balance sheet holding $34.8 million in cash as of December 31, 2025, the January 2026 land sale of $26.8 million, and reduced operational complexity, we continue to believe we are well positioned to advance along our high-value development roadmap."

On the transformation:

"Alico today is fundamentally transformed. We are well-capitalized, strategically focused, and spread across Southwest Florida."

How Did the Stock React?

ALCO shares fell 2.4% on earnings day to $41.00, though the stock has been on a strong run—up 52% from its 52-week low of $27.02 and currently sitting at its 52-week high range of $43.20.

Key context: The stock's resilience reflects market confidence in the land monetization thesis. Management's NPV analysis values the 46,000-acre portfolio at $650-750 million, yet Alico trades at ~$320M market cap with $50.7M net debt—implying an enterprise value around $370M. CEO Kiernan called this a "significant valuation disconnect that we expect will close as we continue to execute on our plan."

What's the Development Pipeline?

Alico's four near-term development projects—Corkscrew Grove Villages, Bonnet Lake, Saddlebag Grove, and Plant World—span ~5,500 acres with an estimated present value of $335-380 million, expected to be realized within five years. This represents value creation from just 10% of total land holdings.

The crown jewel is Corkscrew Grove Villages, a master-planned development on ~4,660 acres in Collier County:

The Corkscrew Grove Stewardship District was approved unanimously by the Florida Legislature, providing the framework for infrastructure financing and natural area management.

Balance Sheet & Liquidity

Alico's balance sheet reflects the transformation progress:

Post-quarter update: The January 2026 land sale of $26.8M (~2,950 acre citrus grove) significantly boosts the cash position. Combined with ~$34.8M at quarter-end, pro forma cash exceeds $60M.

Shareholder Returns

Since 2015, Alico has returned more than $190 million to shareholders through dividends, share repurchases, and voluntary debt reduction. Management explicitly mentioned potential capital returns via "increased dividends, special distributions, share repurchases, or tender offers" as possibilities that could affect FY2026 cash guidance.

Key Risks

- Multi-layer entitlement risk: Corkscrew Grove requires local county approval, state approval, AND federal approval from Army Corps of Engineers and Fish & Wildlife—management said federal will take longest

- Florida concentration: 100% of assets in Florida exposes Alico to hurricanes and local real estate cycles—recent freeze event required employee intervention

- Cash flow visibility: Management deferred farmland utilization cash flow guidance when asked by analysts

- Execution risk: Conversations with national home builders ongoing but "nothing negotiated or solidified"

- Limited liquidity: Small-cap with thin trading volume

What to Watch Next Quarter

- Corkscrew Grove decision: County Board vote expected in 2026

- Land sale pipeline: Additional dispositions beyond $34.5M YTD

- Lease renewals: Maintaining 97% farmable utilization

- Capital return: Any dividend increases or buyback announcements

- Development permits: SFWMD and Army Corps progress

Q&A Highlights

Jerry Sweeney, Roth Capital asked about Corkscrew Grove timeline:

- County approval timing: Management said Q3/Q4 FY2026 (by end of September) is "not an unreasonable assumption" for the county decision, though they don't control the local calendar

- Path to construction: After local approval, Alico still needs state approval and federal approval from Army Corps of Engineers and Fish & Wildlife—the federal level is expected to take longest

- Builder partnerships: "Conversations with national home builders and other developers happen as a regular course of business" but nothing negotiated or solidified

On farmland cash flow guidance: When asked about modeling the 97% utilization rate, CEO Kiernan deferred: "Hopefully next quarter, we might be able to give you a little more clarity."

On Florida freeze event: CEO Kiernan thanked employees for their dedication "over the past weekend, where there was a significant freeze event over Florida" and for cooperating with neighbors to maintain properties.

Data sources: Alico Q1 2026 8-K filed February 4, 2026; Q1 2026 earnings call transcript February 5, 2026; S&P Global market data.